Along a Branch, a Hefty Polkadot Vine Fattens Its Fruit

In the jungle, we commonly think that there can only be one apex predator: a singular beast that dominates all others through its physical status and prowess, that no other can compare. If David Attenborough is a guide to life on earth, he might say that the jungle is instead a collection of ecosystems all rubbing shoulders with each other, all toiling to gain their own slight advantage in the dense growth. As life is so interdependent and intertwined in these paradoxically hostile places, it is hard to say who really controls, owns, or dominates the flora and fauna.

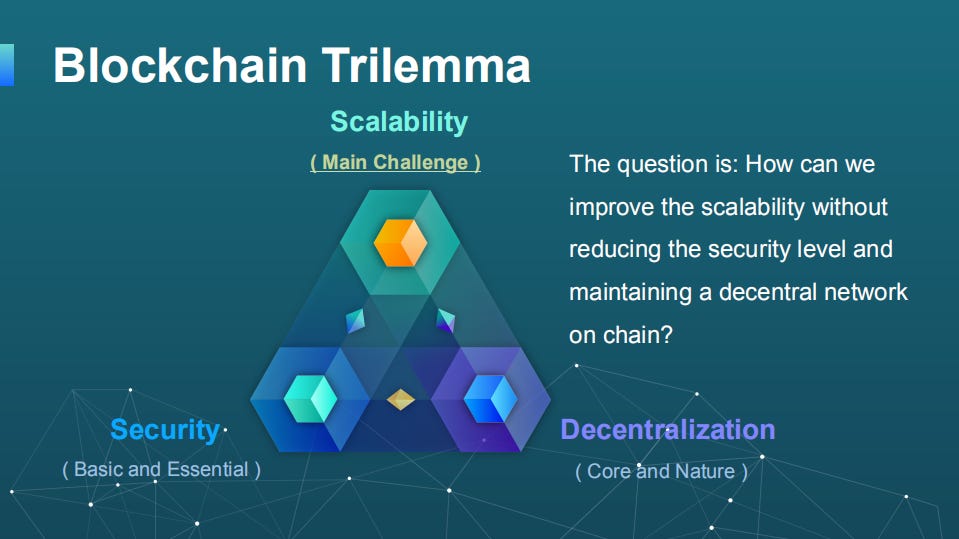

For Web3 to take root, blockchains need to solve the ever-present “trilemma”: security, scalability, and decentralisation.

Such is the comparison in the crypto “jungle” with Ethereum (ETH) and Polkadot (DOT), where ETH was lauded as the mother of all tokens, the infinite beginning and end, the end-all-be-all of programmable tokens. Since its launch in 2015 other contenders come to “rival” Ethereum in its scalability, speed, governance, low-cost and user inclusivity, which is often ironically cited as a reason for its growing list of issues. But being the first kid on the block means that other entrants are always comparing themselves to it, and so is the case with Polkadot.

A fruit from many seeds

The Swiss-based “blockchains of blockchains” (a la Inception) is frequently touted as the Ethereum killer of our time – and who would question that? The founder, Gavin Wood, is an ex-Ethereum CTO and created the Solidity programming language for the virtual machine, is also a former Microsoft employee, and has a PhD. Polkadot and its canary chain Kusama does have the organisational pedigree that will attract attention, and indeed it has. The Web3 Foundation, which provides all the code for the DOT chain, has created a product vehicle where retail and institutional investors have taken great notice of the functionality and concept of this particular blockchain.

All blockchains are faced with a notable “trilemma” that they are promising to solve in order for the foundations of web3 to take root. The issues of decentralisation, security, and scalability have so far been elusive as only two of the three are normally attained. Ethereum has chosen decentralisation and security, leaving scalability a long-term problem to be solved for future developers. The network is currently designed to process 7 transactions per second making it much slower than Visa or Mastercard which are able to process thousands per second. Polkadot (DOT) stands apart from this as they have implemented a form of sharded technology, called parachains and relay chains. These attempt to widen the load to the broadest set of machines in the network so that it is able to perform many transactions simultaneously. This multi-chain ability, therefore, creates an “internet of blockchains” as each nested chain is able to work independently or with Polkadot or to another external network via a bridge. For the moment, the base layer of Polkadot, named Layer 0, is able to host up to 100 other blockchains that are capable of providing Decentralised Apps (DApps), Decentralised Financial protocols (Defi), and much more. This means it’s very much the swiss army knife of blockchains where it can regularly swap a function, app, feature to the network without little delay or wait.

Parachains and paraslots parachute from above

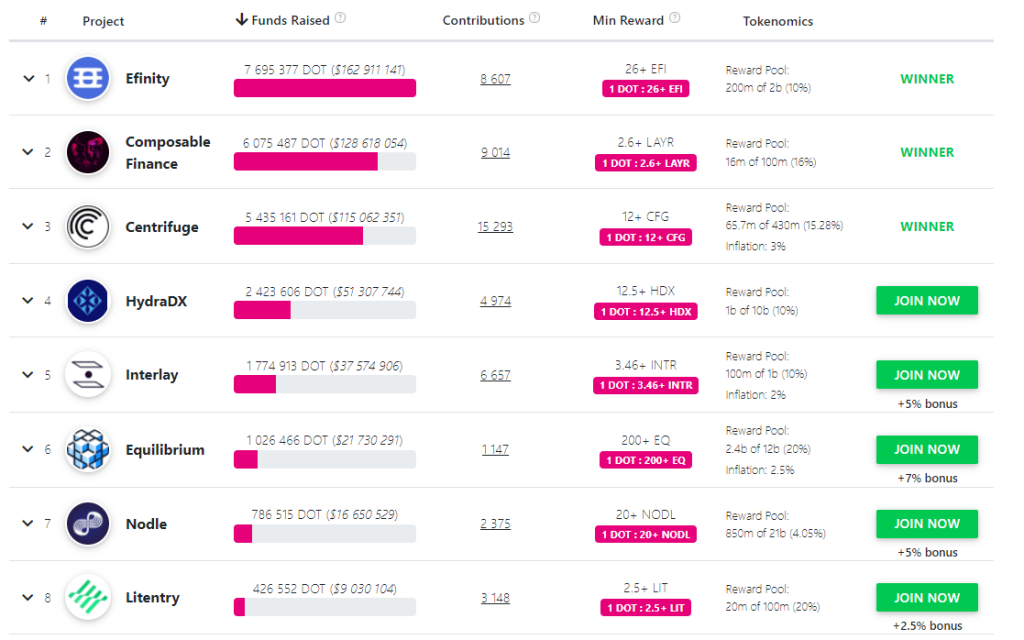

The fruit from above is the once fortnightly Crowdloan auctions on both the main network Polksdaot and the sister canary network Kusama, which allow for a multitude of features to be added. For Polkadot in Feb 2022, we saw The auction for slot number nine, where nearly a dozen projects marketed their wares to the community for their DOTs. Projects, like Efinity, Composable Finance, Centrifuge, HydraX, Interlay, all add yet another feature to Polkadot, like money market protocols, NTF services, Identity Protocols, and more. The minimum Polkadot Crowdloan contribution is 5 DOT (0.1 KSM on Kusama) and so the incentive for smallholders to contribute and fulfil the ambitions of the chain is to be truly decentralised through decision-making.

Each auction uses an ancient maritime auction process called a candle auction, where bidders make an offer in sight of a lit candle and are to make their bids while it was burning. Given that is it not known exactly when the candle will go out, this prevents bid sniping, where the final bidder swoops in to land the final highest bid in the dying seconds.

Polkadot uses a digital version of the same process, and so encourages a thoughtful look at the value proposition of each project in the Crowdloan auction.

Each project assigns a ratio of their own tokens in exchange for lending your DOT to them. For every crowd loan, it means you will have your own DOT lent out for 96 weeks (nearly 2 years) until you can get them back, minus the 15% yearly interest.

The investment thesis is then defined by the amount your project’s token increases subtracting the 2 years of cumulative interest of the DOT you would have normally staked.

A forest in bloom

Polkadot is still in its infancy and is currently under the radar for most crypto investors who are looking to achieve quick returns. The project, compared to meme coins like Shib and others, is relatively complex and requires a deep dive into the financials to judge the entry for an auction slot.

Polkadot’s price will grow with time as more slots are taken up and the ecosystem matures to offer the same, if not better, functionality as Ethereum’s. We are likely to see a quantum leap forward in offerings as the network’s architecture is completely built from scratch and will have incorporated the benefits of hindsight from Dr Gavin Wood.

With big-name venture capital firms joining the mix, like Sequoia Capital, the maturing ecosystem that is crypto is ready to expand the jungle and make space for many other creatures both large and small.