When Nations FOMO – Bitcoin and Game Theory

The fear of missing out (FOMO) is as real as the pain of breaking up with your first love. Dramatic, absolutely, but still nonetheless true. Seeing the S&P500 roar upwards, nearly vertical at times, over the last 3 – 4 years has been an emotional rollercoaster. Just before President Trump’s inauguration, there were rumours that the stock market will tank to new all-time lows, with near certainty that his presidency would see prolonged whipsawing and choppiness. Instead, the market witnessed the Trump Rally, a near-continuous rise in stock prices in almost every sector.

With the continued popularity of cryptocurrencies, countries throughout the world are grappling with the question of how the asset will influence their own monetary policies in the future. El Salvador became the first country to adopt Bitcoin as legal cash when the Bitcoin Law was passed on September 7, 2021. This act has been revolutionary in terms of legitimising cryptocurrencies, and it will serve as a useful benchmark for other countries as they weigh their options in the future. This has raised the question of when other countries will follow suit.

Bitcoin adoption with respect to game theory is based on an assumption that complex social dynamics can be predicted, but any potential outcome is still like predicting the future. Game theory also points out that there are characteristics that need to be defined before we can apply them to a scenario, like that of Bitcoin adoption.

What is game theory?

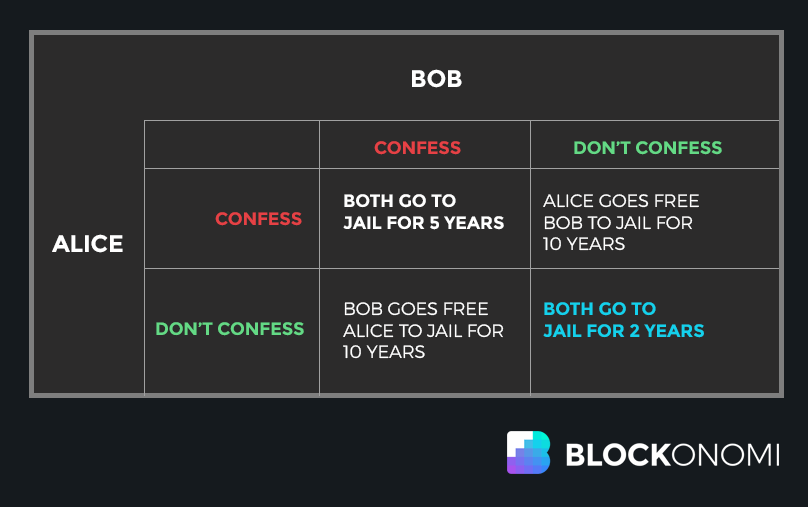

We must first presuppose that allow players (buyers, sellers, nation-states, corporations, exchanges, absolutely everyone) are rational actors, and they are attempting to either “win” or maximise their gain. While this is not strictly true, is similar to scientific assumptions, the first the universe exists and we can understand it. The first see the options in a game-like situation we must first realise that actors are indeed trying to beat other participants and therefore, attempting to maximise their gain in the quickest and most efficient means.

- Any set of circumstances in which the outcome is determined by the acts of two or more decision-makers is referred to as a game (players).

- In the context of the game, a player is a strategic decision-maker.

- A complete plan of action that a player will follow in response to a set of situations that may emerge throughout the game.

- Payoff: The amount of money a player earns for achieving a specific result. The payment can take any form that can be measured.

- The information available at a specific stage in the game is referred to as the information set. When a game involves a sequential component, the phrase information set is most commonly used.

- Equilibrium: In a game, the point at which both players have made their decisions and a result has been obtained.

Finally, in game theory, there are no absolutes, where the winner takes all. It only seeks to understand the options in a given situation.

How is game theory working for nations, corporations, and people?

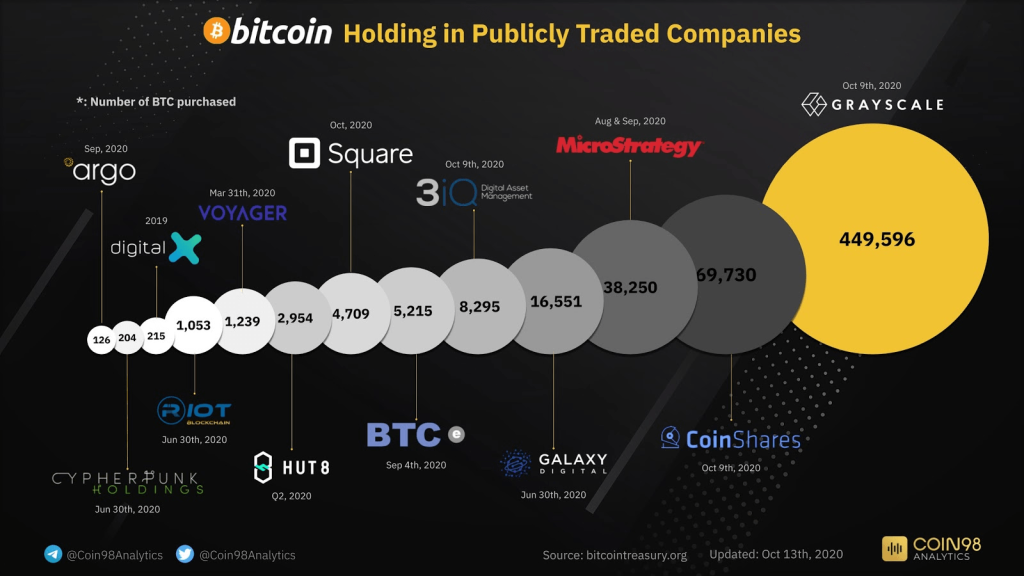

Game theory that may be discovered in the Bitcoin dynamics is from the possible outcome of mass adoption. The initial adopter of a successful technology will benefit the most in this case. This is true in almost every other part of life. The first country or company to upgrade its infrastructure is most likely to benefit from it first.

The scepticism stems from the fact that there is no certainty that Bitcoin will continue to appreciate in value because the asset is risky – as no other asset has been created like it. When faced with the decision of whether or not to incorporate cryptocurrencies into its monetary policy, each country must evaluate whether the value of early adoption is worth the asset’s risk. We are so postulating that the fear of missing out on this financial activity, as well as the opportunity cost of implementing infrastructure too late, will lead to more countries embracing Bitcoin and other cryptocurrencies in the future.

Scenario 1: Russia adopts Bitcoin before the US

In this case, it will mean that the Russian government will be able to have maximum utilisation and value benefits of Bitcoin before the US – leaving them to incur higher adoption costs. Each BTC they try to acquire will be at a higher cost than Russia and so their investment will have a lower return than that of Russia. This might now sound like an awful outcome, as the US still have Bitcoins, but it would be the equivalent to saying that the US Navy must be content with having 20 nuclear submarines instead of Russia’s 500. Some Bitcoin is good, but more will always be better. The limited supply of the asset will force players to acquire as much as possible as early as possible. Any delay will mean each additional unit will come with a higher cost.

Scenario 2: Mastercard adopts Bitcoin before Visa

Mastercard will have the first-mover advantage and will establish itself as a cutting edge payments provider. The marketing and advertising reward from this will be enormous as high-profile celebrities like Elon Musk and others will lend their interest to their move. There will also be a new cohort of subscribers and users to their services.

It might be simple to say that Visa can then also adopt BTC as payment, so making it on par with Mastercard, but the perception of being a follower and not a technology leader would be damaging for their public perception. There might also be a thought that they could have implemented crypto integration sooner but chose not to. In this sense, perception is more powerful than facts.

Nations will FOMO

Another facet of game theory that is present in Bitcoin’s global adoption is viewing the scenario as a coordination game, in which players have a common aim of coordinating the same approach. As more individuals use Bitcoin as a legitimate payment mechanism, each country will earn a higher dividend. The incentive matrix for Bitcoin diplomacy is not as extreme as a zero-sum situation, but if governments can coordinate their adoption of the token, it will only strengthen the technology’s confidence and stability.

Cryptocurrency game theory dynamics will continue to evolve and will likely become one of the most exciting concepts in the business. Their importance in terms of security, validity, and viability cannot be overstated, and their ultimate success or failure in decentralised networks will be determined in real-time as new platforms go up and attract increasing numbers of users.

The area of crypto-economics is still in its early stages, with ramifications that extend beyond cryptocurrency platforms to the greater development of game theory mechanics.