Ape JPEGs, Virtual Homes? You Haven’t Seen What NTFs Can Really Do

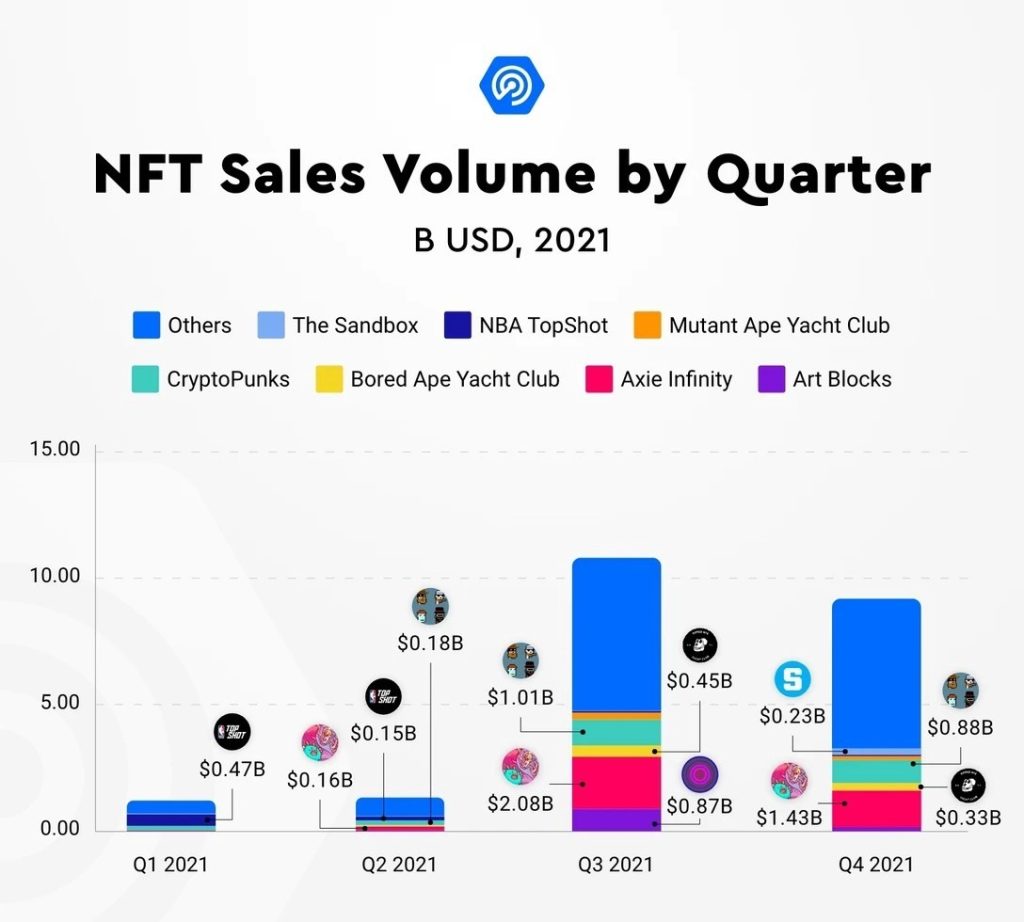

The eager crypto watcher would have seen how NTFs came to the scene like an atomic blast from way out over the ocean. The sudden and sweeping change has influenced how people now see crypto, from an investable digital currency (BTC) or programmable money (ETH), but NTFs have captivated a new tranche of users.

What is an NTF and how do they work?

“Non-fungible” basically indicates it’s one-of-a-kind and can’t be substituted with anything else. Many assume that Bitcoin, for example, is fungible (Shhh, Monero is actually fungible), meaning you can exchange one for another and get precisely the identical thing. A one-of-a-kind trade card, on the other hand, cannot be duplicated. The inability for the network to make this token interchangeable with anything else preserves its contents and the use cases it naturally presents. You’d get something altogether different if you swapped it for a different card. In the real world there are many examples of these NTFs which can not be duplicated:

- A 1923 gold Sovereign coin minted in Pretoria, South Africa is listed as one of the rarest gold coins made by the British Empire, with only a few hundred minted (583), ever. At auction, these coins fetch for over $11,000, with fine examples reaching much higher.

- A Pokemon card from 1998, like the one seen below, is far more rare and sought after, with a recent example sold for $375,000 in February 2021, a world record.

Most NFTs are, at a high level, part of the Ethereum blockchain. Ethereum, like bitcoin and dogecoin, is a programmable cryptocurrency, but its blockchain also enables these NFTs, which store additional information that allows them to function differently from, say, an ETH coin. It’s worth mentioning that various blockchains can use NFTs in their own ways. Newer blockchains, like Polkadot, are incorporating their own NTFs that will run natively on-chain. The space is growing in both technical ability and financial inflows.

NFTs have achieved notoriety as a result of the media frenzy surrounding them. Cynics sneer at cartoon ape jpegs and accuse them of fraud and exploitation, and their suspicions aren’t entirely unwarranted.

Jabberwocky

NFTs can be anything digital (drawings, music, even your brain being downloaded and transformed into an AI), but the current buzz is focused on exploiting the technology to sell digital art. There have been slightly awkward incidents with NTFs, especially from high profile auctions in Christie’s and Sotherby’s, where people have questioned why they are able to copy the actual JPEG of the files that are being sold. What is commonly misunderstood in this situation is that the NTF token grants the waller owner the right of ownership. Just like with a rare coin, or pokemon card, the owner could be anyone and the image associated with it can be public. For houses, the deeds are always public documents but actual ownership belongs to the identified owner through a central database, like a land registry. This is similar to the blockchain.

NFTs have achieved notoriety as a result of the media frenzy surrounding them. Cynics sneer at cartoon ape jpegs and accuse them of fraud and exploitation, and their suspicions aren’t entirely unwarranted.

Every NTF is unique, even if the image, video, and audio file is the same. They are seen by the blockchain as a unique item.

The art of an ecosystem

This technology is more than just funnelling money to the top of the art ecosystem, it is instead flattening the arch of power and money that is available to all artists. More “premium” artists would need to court a benefactor, a person of great wealth and influence, to fund their productions, promote them at dinner parties, and make their worth skyrocket.

Image: Beeple

These “blockbusters” almost celebrities are headline guests at galleries around the globe. In the physical world, there is a high cost to sourcing talent, installing art, promoting their work, and ultimately, the chances of a lesser connected artist, or someone without a heavy trust fund to back their early life is low. Arguably, the best singers, inventors, artists, ultimately came from nothing.

With NTFs and online galleries, anyone can become a patron to any artist. The cost to go global and attain a following in the respectable circles of the art world is now becoming close to zero. Minting an NTF with artwork is as much as the fee for the transaction, for ETH, that’s around $50, and on other blockchains, it will be much lower.

Big brands, and bigger bucks

Taco Bell, Crockpot, Budweiser, Nike, Meta (Facebook), Addidas, Campbell’s, and Twitter are just a few of the companies that have jumped into the ever-growing sector, and more are joining every day. The opportunity they present to make limited edition collectability is naturally obvious.

Bead and circuses, tickets, concerts, and entertainment.

Tickets are a type of gating system that allows people to get entrance to an event or offer. A ticket, whether for a trip, a class, or a concert, is a one-of-a-kind pass that only the holder has access to. While centralised businesses such as airlines will likely want to retain things as they are and keep passenger data on their own servers, NFTs have the potential to transform event ticketing.

NFT tickets are fraud-resistant in various ways thanks to blockchains’ transparent and immutable features. The owner of the wallet in which the NFT resides can be checked to ensure that the person presenting the ticket is the owner of the wallet in which the NFT resides. An NFT ticket can be destroyed upon entry to prevent would-be scammers from reusing or reselling the ticket. Finally, NFT tickets advertised for sale on secondary marketplaces before an event can be easily confirmed, saving fans the agony of showing up to an event with a bogus ticket. These marketplaces can be Decentralised Exchanges (DEXs) and therefore omits the need for TicketMaster and other intermediaries and allow people to exchange tokens themselves freely, further reducing transactional friction.

The same attribute also allows designers to combat ticket scalping by allowing them to void any resold tickets. NFT tickets, interestingly, allow creators to establish a maximum resale price that, if surpassed, invalidate the ticket. In this approach, a creator might allow secondary sales on the proviso that they do not surpass the original ticket price, ensuring that all fans pay a fair price. Alternatively, all secondary sale revenues in excess of the original ticket price could be allocated to the artist, a predetermined charity, or any other destination of the author’s choosing. Delegating different percentages of secondary sale proceeds to several beneficiaries can be added to these processes

Memberships, followers, patrons, and more

Web 3.0 is being embraced by adult content. Users can now use NFTs as their profile photographs on OnlyFans, a subscription service where content creators can upload sexually explicit content. The feature is similar to one announced by Twitter last month, in which the profile image expands in detail to verify that the user owns the underlying NFT. The image will be accompanied by an Ethereum emblem, which visitors may click to learn more about the digital item on OpenSea.

If users want to trade these items in the future, then during the minting process, the original owner can program these tokens to allow for a 5% or more kickback for every transaction, ensuring a royalty for in perpetuity.

The next, next

Bleeding edge tech is never easy to conceptualise in the present day especially when use cases appear incredibly flimsy. That said, NTFs open the door to do away with another layer of middle-level companies that profit from culture and therefore allow them a privilege to self-select their own favourites to be enjoyed. Democratising the ability to become a patron and then truly own your ticket to that experience will become a feature that will define the next generation of creators.