Inflation, Fear, Bitcoin, and Fraudsters

Old Skool fraud

When we think of the United Kingdom, there are certain stereotypes that come to the fore that, to some degree hold true, but fraud might not be one of those characteristics. In late January a Conservative minister in the House of Lords resigned after attacking the UK government’s handling of COVID business loans. These Bounce Back Loans were offered during the COVID-19 pandemic and totalled up to £73bn (yes, that’s a billion) in cash to a variety of businesses. Many smaller businesses were able to apply for £60,000 without much due diligence or oversight, which led to huge losses from lenders as many simply did not pay. Some “fraudsters” used the cash on new Ferraris or Porsches Such was the inflow of money that the FT reported events as “a giant bonfire of taxpayers’ money“, and so it was. It is estimated that nearly half will never be paid back causing indebtedness to the country and future taxpayers.

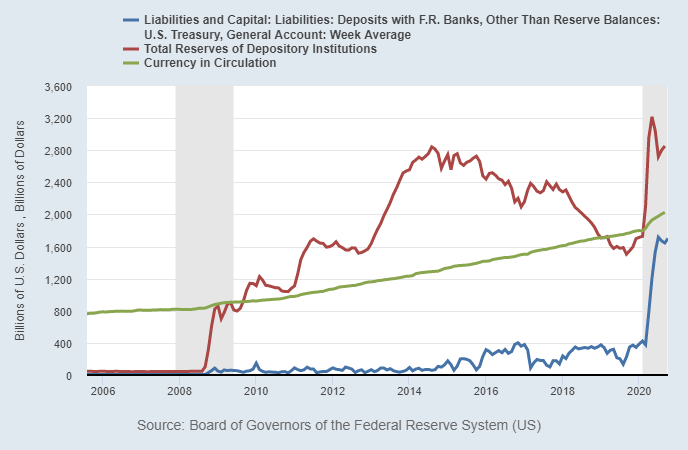

Amidst this backdrop, there was unprecedented money printing from central bankers. The Federal Reserve (as Federal as FedEx), Bank of England, and more, rained money from upon high, blanketing the planet with newly diluted currency. The BoE sold more than £533bn in new bonds, a figure not seen in history. And the FED blessed us all with an additional 80% of US dollars in existence during the same time frame, with the US national debt in 2022 now standing at $30 trillion. This excessive liquidity is a tax upon the poor and barely getting by, their ability to make ends meet means they will need to choose between heating their home or eating for that evening. With only minor upwards wage growth after nearly 15 years of no movement, the pressure on households is becoming clearer.

Central bankers are ever pressed to find new ways to provide us with new comedy material. Andrew Bailey, the current Bank of England governor, recently asked workers not to ask for a pay rise this year, despite inflation at 5% (officially), rampant money printing, and a decade of lost pay. The reason? “We do need to see restraint in pay bargaining, otherwise it will get out of control”. Interestingly, this would be his Mary Antionette moment, asking the plebs to eat cake instead of bread, as the BoE’s only remit is the reign in inflation using interest rates, which are currently near zero. What is clear, workers pay the price of the folly of our leaders. Free money, printed, loaned, unrepaid, or simply forgotten about, is this what modern financial repression looks like in the developed world.

The banks can now see Bitcoin

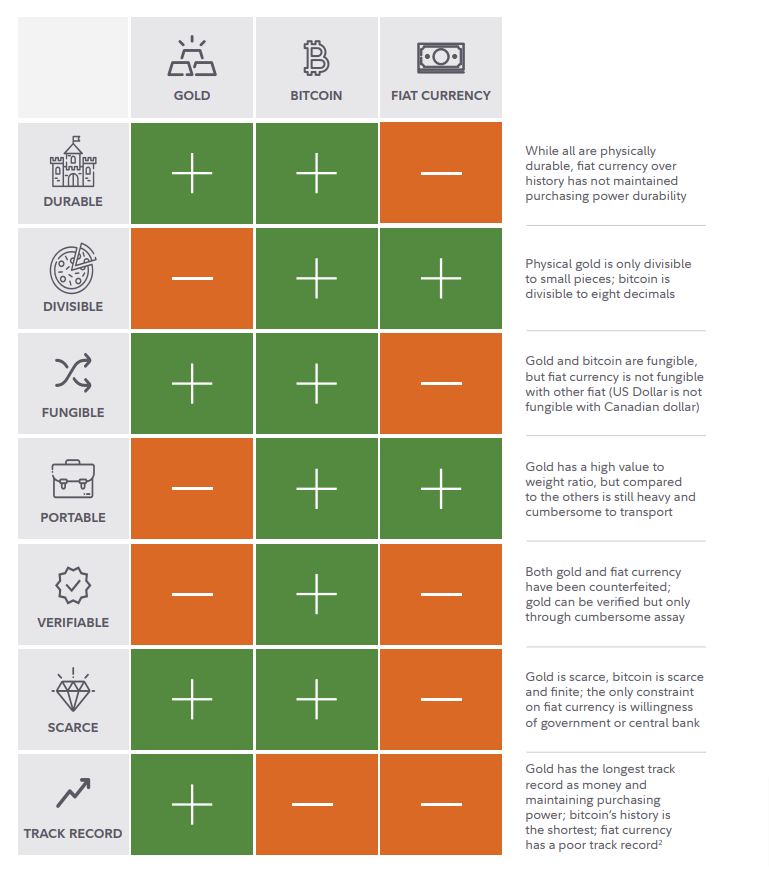

With the traditional money changers continuing their usual antics, crypto offers logic and common sense. During this same period, Bitcoin (BTC) produced no more blocks than it needed and instead carried on calmly. Ethereum (ETH) pushed forward its plans for sharding in preparation for its forthcoming major improvement and move away from Proof of Work to Proof of Stake. Some foundations even managed to come to market, like Polkadot (DOT). The industry saw growth in anticipation of the Bitcoin halving and the expected crackup boom seen at the end of every 4-year cycle. All was normal.

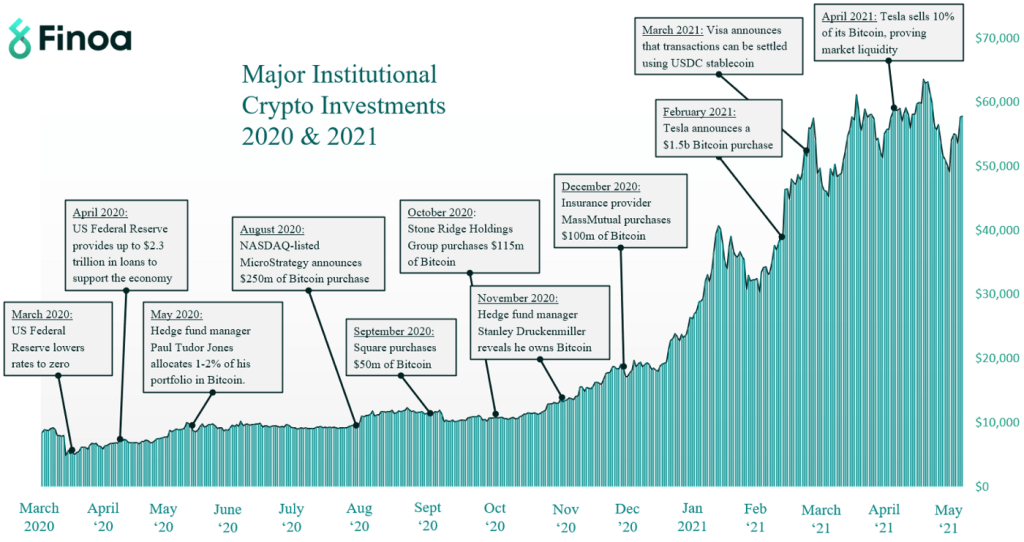

As fiat currency globally was inflating, the writing was on the wall and so institutional investors, hedge funds, venture capitalists, angel investors, and asset managers were all pondering the advantages of a deflationary currency (or asset) that has little external influence. Bitcoin has seen favourable coverage and analysis from Fidelity that is set to launch the world’s first spot price BTC ETF. With previous statements indicating their belief Bitcoin as a superior monetary good is more valuable than a better payment network. Maybe they have finally seen the light or there are other macro push factors, a world awash with infinite currency.

More news from KPMG as they have also announced they will be holding BTC as they see it as a maturing asset class. The question for all this investment is how the culture of these organisations will change that of crypto and the market. We have seen in recent months that algorithmic trading is seeing the price of BTC moving in tandem with the wider NASDAQ and S&P, making it a correlated asset – a feature drawing ire from the community. After being criticised, laughed at, and almost regulated out of existence, that last feeling some are hoping for is the cold embrace of institutional money. Their vast treasures will help boost the fiat price of BTC but it will naturally lead to traditional finance becoming the silent partner in the sector and so, creating an odd marriage.

Companies that make money in the fiat economy, selling over-priced financial products, targeting those less capable of eluding their intricately designed products to capture decades of productivity, now want the Bitcoin pie. The organs and apparatus that have repressed people with tacit support from the state where black-owned firms are twice as likely to be rejected for loans, have been found money laundering for drug cartels and fixing the price of gold and silver for decades, now want honest money. With a record like that it’s hard to know if this is a blessing or a curse. The saving grace of crypto is its innate decentralised nature. It is that same feature that can perhaps prevent the big money players from totally capturing the sector and revitalising their ability to orchestrate mass financial repression on the population.

True to their word?

Are institutional investors to be believed that they are now converted to Bitcoin? With governments still leaving the printing presses on full, we can only help but wonder if crypto is the last liferaft in a fiat world.