Messari Founder Ryan Selkis says ‘Bitcoin a Contrarian Bet’ for 2022

According to Ryan Selkis, the creator of crypto analytics business Messari, bitcoin (BTC) is a “contrarian bet” for 2022, implying that the commodity could perform poorly in a market it has long dominated.

According to Selkis, the crypto industry’s dynamics have shifted. Investors are pushing a lot more money into assets that offer a greater short-term return, he argues, while Bitcoin die-hards remain focused on BTC and Ethereum maximalists on ETH.

He refers to these investors as “crypto mercenaries,” or “degens” to regular bitcoin users. They usually go for new layer-one digital assets like Solana (SOL), Terra (LUNA), and Avalanche (AVAX), a trio that has become known as SoLunAvax.

SoLunAvax has swayed large quantities of money in the last year.

According to some data, from Ethereum and maybe Bitcoin. Other emerging blockchains, including Cosmos, Near, and Polygon, have all claimed a piece of the pie. A growing userbase for Algorand (ALGO) is also following suit given its fast block times and low unit cost.

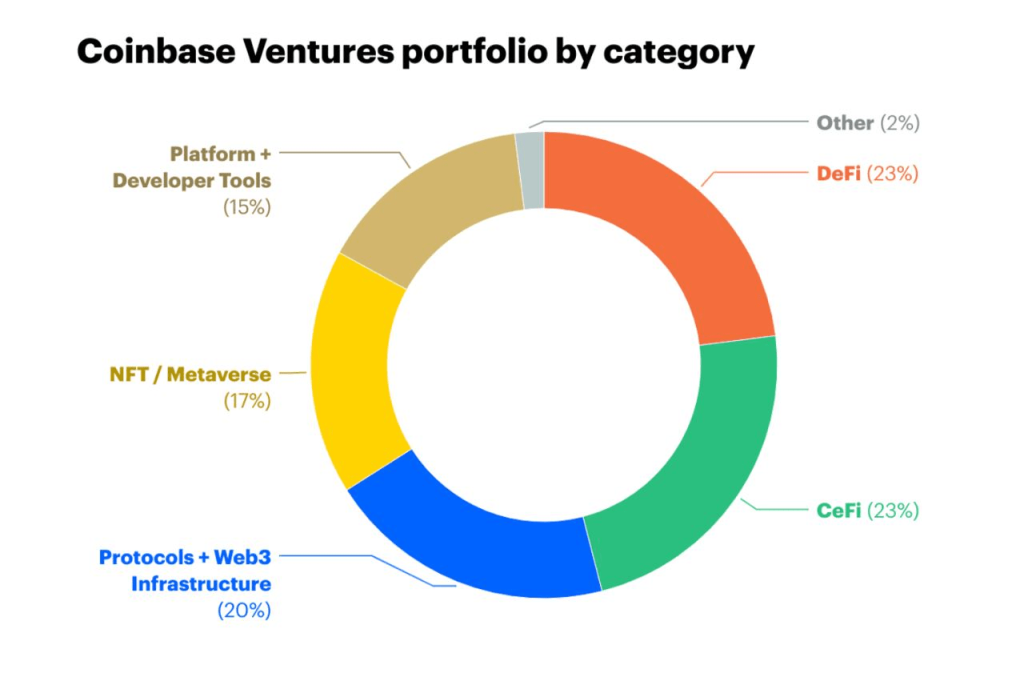

Another group of investors, according to Selkis, would “never go for bitcoin.” He refers to these people as “generalists,” and they prefer anything other than BTC. Specifically, “generalists” are attracted to a mix of layer-one crypto assets, decentralised finance (Defi) assets, and others.

In that regard, according to a recent tweet from Messari’s founder and CEO, “Bitcoin is the contrarian gamble for the year.”

Bitcoin’s market share is dwindling with 35% of the total invested in cryptocurrency being placed in the orange token.

While some experts believe that the price of Bitcoin will rise, thanks to increased institutional adoption, will reach $100,000 this year Ryan Selkis remained deafeningly mute on the subject of price.

However, the tendency shows that bitcoin’s market share in dominating terms would continue to decline in 2022, maybe to as low as 10%, as one analyst projected. Bitcoin’s market value vs altcoins (essentially any other crypto asset that isn’t BTC) has dropped to 39.3%, its lowest level since June 2018.

According to the data, more users are abandoning bitcoin in favour of altcoins. This aligns with Selkis’ expectations for a “contrarian bet.” Furthermore, falling dominance could indicate that some altcoins, notably layer-one blockchains like Terra, Fantom, or Avalanche, are decoupling from BTC’s price action.

One of the most obvious reasons is that according to crypto expert Austin Barack, Bitcoin’s failure to evolve as a useful asset. Bitcoin has been unable to attract developers who wish to create more useable protocols and applications on top of the cryptocurrency. It has also struggled to handle rising transaction volumes, necessitating the creation of other blockchain networks. Bitcoin risks losing even more ground if newer networks gain traction if maximums refuse to adapt.